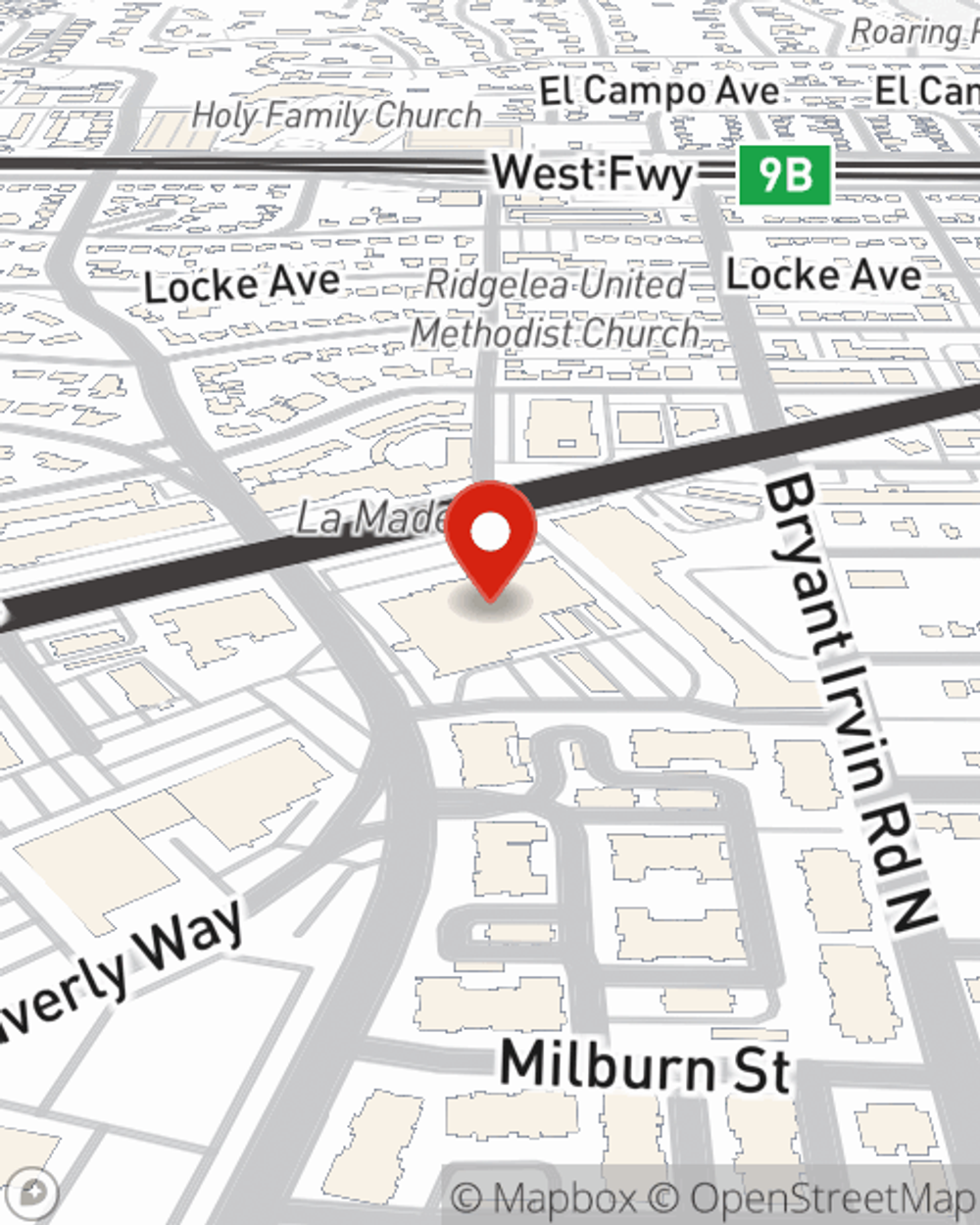

Business Insurance in and around Fort Worth

Searching for insurance for your business? Search no further than State Farm agent Josh Hanna!

Helping insure small businesses since 1935

Coverage With State Farm Can Help Your Small Business.

Running a small business is hard work. Getting the right insurance should be the least of your worries. State Farm insures small businesses that fall under the umbrella of contractors, trades, specialized professions and more!

Searching for insurance for your business? Search no further than State Farm agent Josh Hanna!

Helping insure small businesses since 1935

Protect Your Future With State Farm

The passion you have to contribute to your community is a great foundation. When you add business insurance from State Farm, you can be ready for the challenges ahead. That’s why entrepreneurs and business owners turn to State Farm Agent Josh Hanna. With an agent like Josh Hanna, your coverage can include great options, such as business owners policies, commercial liability umbrella policies and commercial auto.

With over 300+ businesses eligible to be insured by State Farm, look no further for your business coverage needs. Agent Josh Hanna is here to help you identify your options. Call or email today!

Simple Insights®

Fire safety for businesses

Fire safety for businesses

Learn workplace fire safety and prevention tips to help protect your employees and business.

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

Josh Hanna

State Farm® Insurance AgentSimple Insights®

Fire safety for businesses

Fire safety for businesses

Learn workplace fire safety and prevention tips to help protect your employees and business.

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.